Comparing Unsecured Personal Loans: A Guide

An unsecured personal loan is a type of loan that does not require the borrower to provide collateral. Unlike secured loans, where you might have to put up assets such as your car or home as security, unsecured loans rely on your creditworthiness. This means lenders in the UK will assess your credit history, income, and affordability to determine your eligibility. Understanding the nuances of unsecured loans is crucial for anyone considering this financial option.

The Mechanics of Unsecured Personal Loans

Unsecured personal loans are straightforward in their functioning. The lender provides you with a sum of money, which you agree to pay back over a set period through regular instalments. The interest rate applied to these loans can vary depending on your credit history, the lender’s policies, and market conditions. Without collateral, the lender assumes more risk, which influences the terms they offer. This risk assessment is primarily based on your credit profile and overall financial health.

Key Differences Between Secured and Unsecured Loans

Secured and unsecured loans differ mainly in their risk management and collateral requirements. While secured loans demand collateral, making them less risky for lenders, unsecured loans are based on your ability to repay without providing assets. This difference significantly impacts interest rates and loan terms, with unsecured loans often carrying higher rates due to the increased risk for lenders. Understanding these differences can help you decide which loan type best suits your needs.

Common Uses of Unsecured Personal Loans

Unsecured personal loans in the UK are highly flexible. Borrowers often use them for:

-

Consolidating existing debts.

-

Financing home improvements.

-

Covering unexpected or emergency expenses.

Unlike some specific-purpose finance products, unsecured personal loans do not require you to justify how the funds will be used, allowing you greater freedom in managing your finances.

Assessing Eligibility for Unsecured Personal Loans

Eligibility for unsecured personal loans hinges on several factors, including your credit history, income, and existing debt. UK lenders are also required to carry out affordability checks under FCA rules. A strong credit file can open the door to more competitive terms, while a lower credit rating might mean fewer options or higher interest rates. Understanding these eligibility criteria can help you prepare and improve your chances of securing favourable terms.

Benefits of Unsecured Personal Loans

No Collateral Required

One of the most significant benefits of unsecured personal loans is that they do not require collateral. This means there is no risk of losing your home or car if you default. For borrowers without assets, or those who prefer not to secure borrowing against property, this can be an attractive option.

Flexible Use of Funds

Funds can be used for almost any purpose, from consolidating credit cards to paying for a wedding. This flexibility makes unsecured loans a versatile way to manage both planned and unforeseen expenses.

Fixed Interest Rates

Many unsecured personal loans in the UK come with fixed rates, meaning your monthly repayments remain the same for the life of the loan. This predictability makes budgeting easier and protects you from interest rate rises.

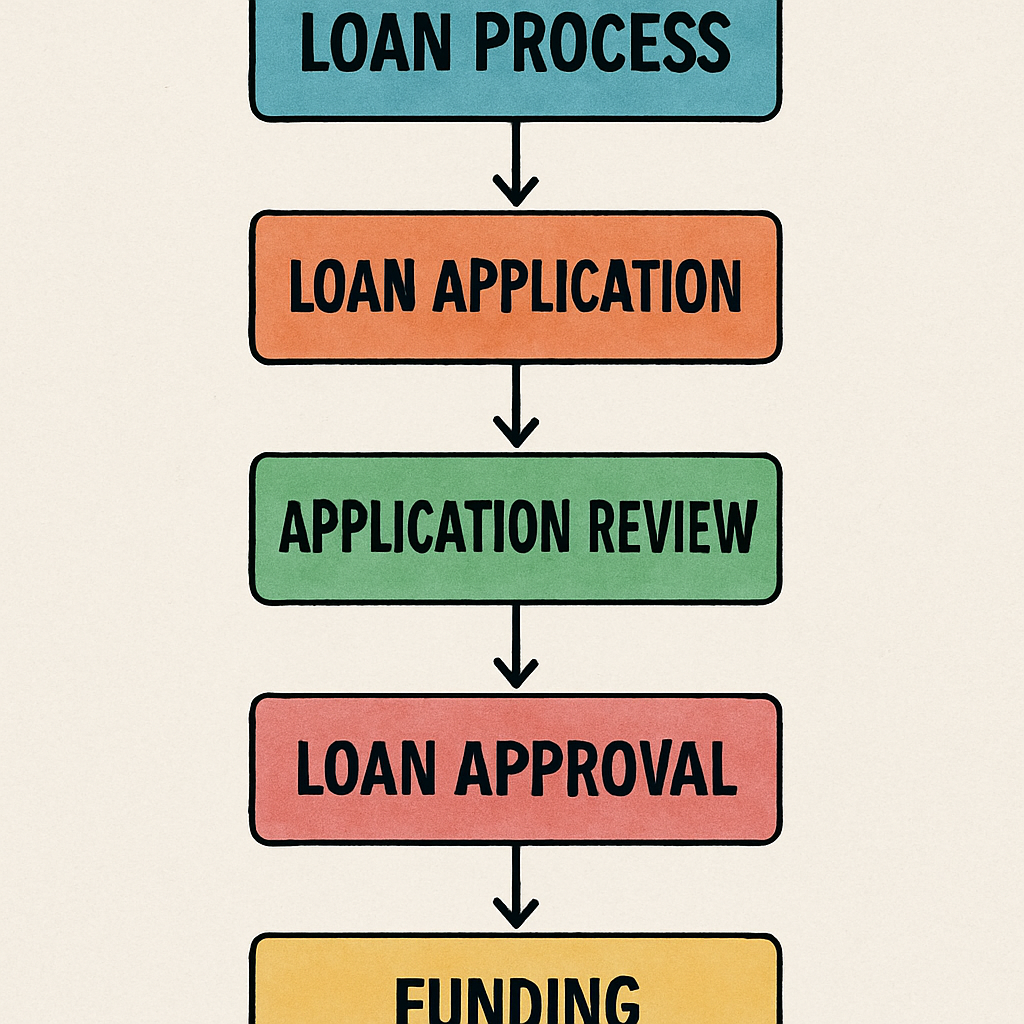

Quick Approval Process

Because there’s no need to value assets, unsecured loans are often approved quickly. Many online lenders and comparison sites in the UK now offer near-instant eligibility checks, making them suitable for those needing funds promptly.

How to Compare Unsecured Personal Loans

When comparing loans, consider more than just the monthly repayment:

Evaluating Interest Rates

Always look at the Representative APR. By law in the UK, this must be shown so you can compare products fairly. The APR includes both the interest rate and any compulsory fees, giving you a clearer picture of the true cost.

Understanding Loan Terms

Most UK lenders offer terms from 1 to 7 years. A longer term means lower monthly payments, but higher overall interest. Balance affordability with the total cost when choosing.

Scrutinising Fees and Charges

Although many UK personal loans come with no early repayment fees, some do. Others may include arrangement fees. Always check the small print.

Assessing Loan Amounts

Typical unsecured loan amounts in the UK range from £1,000 to £25,000, though some lenders may offer more. Ensure the loan covers your needs without encouraging over-borrowing.

Evaluating the Lender’s Reputation

Check independent reviews and consider whether the lender is FCA-authorised. Established banks and well-rated online lenders provide greater reassurance than lesser-known operators.

Understanding Credit Scores and Their Impact

Your credit history plays a major role in whether you are approved and what rate you are offered. UK lenders check with credit reference agencies (Experian, Equifax, TransUnion). A higher score usually means access to lower APRs, while weaker scores may mean higher rates or fewer choices.

Tips to Improve Your Credit Score in the UK

-

Pay bills on time – late payments harm your file.

-

Reduce existing debt – improves your credit utilisation.

-

Register on the electoral roll – boosts your credit profile.

-

Limit applications – too many credit checks can lower your score.

-

Check your report for errors – and correct any inaccuracies.

Types of Lenders in the UK

-

Banks & Building Societies – High street lenders often provide competitive unsecured loan rates to existing customers.

-

Online Lenders – Digital-first lenders offer convenience and often faster decisions.

-

Credit Unions – Member-owned organisations offering fair loans, though usually smaller in size.

-

Peer-to-Peer Platforms – Connect borrowers with investors, often through regulated UK platforms.

-

Specialist Lenders – Cater to those with specific needs, such as bad credit histories.

Final Thoughts

When seeking an unsecured personal loan in the UK, it’s important to compare carefully. Consider the Representative APR, loan term, fees, and lender reputation before making a decision. Maintaining a healthy credit file will also improve your chances of approval and access to better rates.

By understanding how unsecured personal loans work and comparing products effectively, you can make an informed choice that supports your financial goals. Taking time to research lenders and terms can lead to a smoother borrowing experience and greater financial security.

Tax Implications of Family Loans Explained

Tax Implications of Family Loans ExplainedWhen money changes hands between family members, it’s rarely just about the cash. These loans often carry emotional weight and expectations, which can complicate what might otherwise be a straightforward financial transaction....

Navigating Loans for Self-Employed Individuals

Navigating Loans for Self-Employed Individuals Securing finance as a self-employed person can feel more complex than it is for salaried employees. Without a fixed monthly payslip, freelancers, contractors, and business owners often face stricter affordability checks...

How to Use a Car Finance Calculator

How to Use a Car Finance CalculatorCar finance calculators are online tools that help you estimate your monthly car finance payments. By inputting basic information such as the loan amount, interest rate, and agreement length, you can get a clear picture of what you...

The Importance of PCP Quotes

Understanding the Importance of PCP QuotesWhen you’re in the market for a new car, understanding your financing options is crucial. One of the most popular methods for financing a car in the UK is through a Personal Contract Purchase, commonly known as PCP. This...

The Basics of Loans Explained

Understanding the Basics of Loans ExplainedWhen it comes to managing finances, loans are a common tool that many people use. But what exactly is a loan, and how does it work? In this article, we'll break down the basics of loans, covering everything from definitions...

Street UK Loans: A Comprehensive Guide

Understanding Street UK Loans: A Comprehensive GuideIn today's world, finding the right financial solution can be daunting, especially when faced with unexpected expenses. Street UK Loans offers a viable option for those needing financial assistance. In this...

Quick Guide to Same Day Business Loans

Quick Guide to Same Day Business LoansIn today’s fast-paced business environment, having quick access to funds can be crucial for small business owners. Whether you’re looking to seize an opportunity, manage cash flow, or cover an unexpected expense, same day business...

Is Debt Consolidation Right for You?

Is Debt Consolidation Right for You?Debt can feel overwhelming, and the stress of managing it can seep into every aspect of your life. From juggling multiple payments and dealing with high interest rates to keeping track of various due dates, the chaos can be mentally...

Joint Loan Eligibility Calculators

Understanding Joint Loan Eligibility Calculators In today’s financial landscape, taking out a loan is a common practice for many individuals and couples. Whether you’re planning to purchase a home, consolidate debt, or finance a major purchase, understanding how joint...

Debt Repayment Calculators: A Guide

Understanding Debt Repayment Calculators: A GuideManaging debt can be overwhelming, but debt repayment calculators can make it easier to create a plan and stay on track. These tools help you understand how long it will take to pay off your debt, what your monthly...

Guaranteed Business Loans: A Guide

Understanding Guaranteed Business Loans: A GuideIn today's competitive economic landscape, securing financial support can be a critical turning point for small businesses. Whether you're looking to expand, stabilize operations, or simply navigate through challenging...

Help to Buy Interest Rates

Understanding Help to Buy Interest RatesBuying a home is one of the most significant financial decisions you'll ever make, and understanding the various schemes available to help you get on the property ladder can be overwhelming. One of these options is the Help to...

Mortgage Types: A Comprehensive Guide

Mortgage Types: A Comprehensive GuideWhat is a Mortgage? A mortgage is a type of loan specifically designed to help you buy a property. When you take out a mortgage, you borrow money from a lender, such as a bank or building society, and repay it in monthly...

The Benefits of Lending Guarantees

The Benefits of Lending GuaranteesSecuring a loan can often feel daunting, particularly for small businesses and startups in the UK. Traditional lending requirements, such as strong credit history or significant collateral, can put vital funding out of reach. This is...

Common Mistakes in Debt Consolidation Loans

Common Mistakes in Debt Consolidation LoansDebt consolidation loans can be a lifeline for those in the UK looking to streamline their finances and reduce the stress of juggling multiple repayments. However, the process isn’t always as straightforward as it sounds....